RV Financing

What We Offer

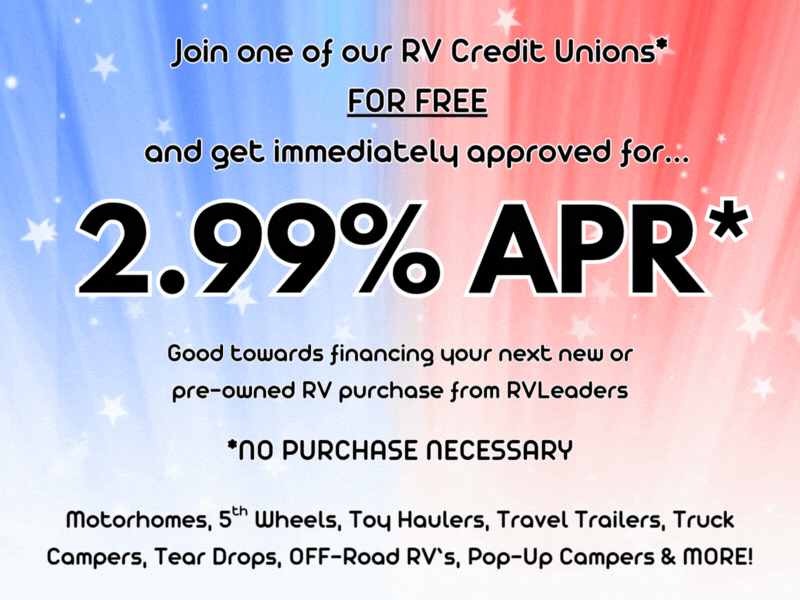

We are offering an amazing finance promotions for a limited time with CUDL! You could qualify for No Interest For 6 Months, No Money Down or even 2.99% APR when you finance with us! Also, you could get an RV loan for up to 20 years if you qualify! We work with 18 RV financing lenders across the nation to offer you the most flexible and competitive RV loan options. Often, RV financing is a better option than paying cash. In many cases, your RV loan interest may even be tax-deductible as a second-home mortgage interest. Let our RV financing experts help secure a loan for you today!

Why Finance Your RV?

When you finance your RV purchase instead of liquidating assets or paying cash, you maintain your personal financial flexibility. Plus, your RV may qualify for some of the same tax benefits as a second home mortgage. To qualify for these benefits, such as the deductibility of interest on the loan, the RV must be used as security for the loan and provide basic living accommodations, including a sleeping area, bathroom, and cooking facilities. The RV is considered a qualified second residence as long as you designate it for each tax year.

What Are the Advantages?

Lower Down Payments: Final terms depend on your credit, the RV year, type, and purchase cost, but financing through RV lenders often requires down payments as low as 10% in some cases.

Longer Finance Terms: Meaning your monthly payments are lower! Because RV lenders know that RVs maintain their value and resale appeal, they offer more attractive terms. In fact, it’s not uncommon to find 10 year or 20 year RV loans to help you afford the RV of your dreams!

Is an RV Loan Tax Deductible?

Yes, in many cases, the interest on your RV loan is tax-deductible. Other elements of your RV expenses, such as sales tax on the original purchase price, may also qualify. We recommend speaking to your tax advisor for further details.

What Are Typical RV Loan Terms?

RV loans typically range from 3 to 20 years, depending on the loan type. Your exact RV financing terms will vary based on whether your loan is secured or unsecured, your down payment, credit score, and the total cost of the RV you’re purchasing.

What Are Typical Interest Rates for RV Loans?

RV loan interest rates vary depending on several factors. For example, your credit score can significantly influence your interest rate. However, many other factors also determine your interest rate.